As a firm evaluates all of its projects takes center stage, this opening passage beckons readers with authoritative prose into a world of meticulous analysis and sound decision-making. This comprehensive exploration delves into the intricacies of project evaluation, empowering firms to optimize their portfolios and achieve unparalleled success.

The subsequent paragraphs provide a detailed roadmap for effective project evaluation, encompassing both financial and non-financial criteria, quantitative and qualitative methods, and a systematic selection process. By adhering to industry best practices and leveraging the insights gleaned from thorough evaluations, firms can align their projects with strategic goals, maximize returns, and elevate their overall performance to new heights.

1. Firm Evaluation Overview: A Firm Evaluates All Of Its Projects

Evaluating projects is crucial for firms to make informed decisions and maximize their returns. It allows them to assess the viability, profitability, and potential risks associated with each project.

Project evaluation provides valuable insights that guide firms in selecting the most promising projects that align with their strategic objectives and contribute to their overall performance.

2. Evaluation Criteria

Firms employ a range of financial and non-financial criteria to evaluate projects. Financial criteria include:

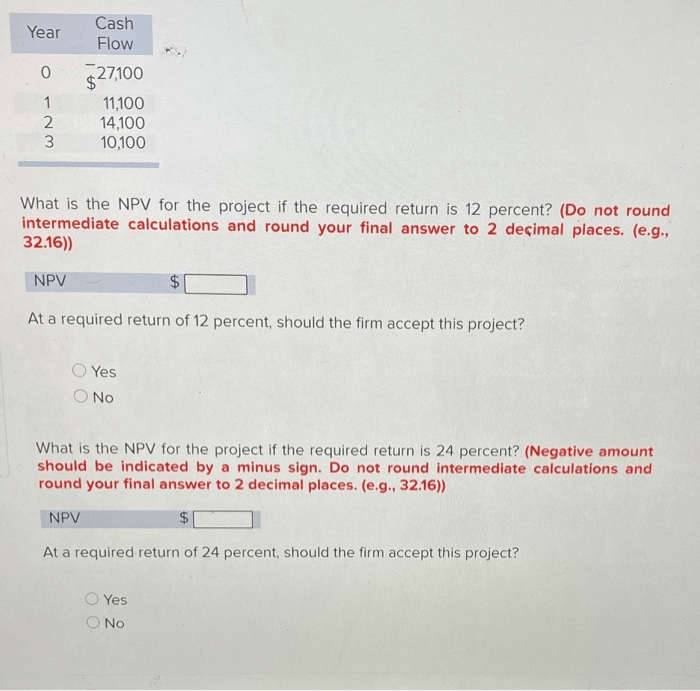

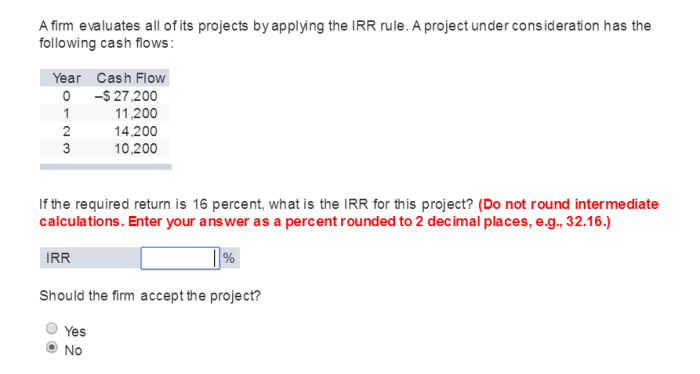

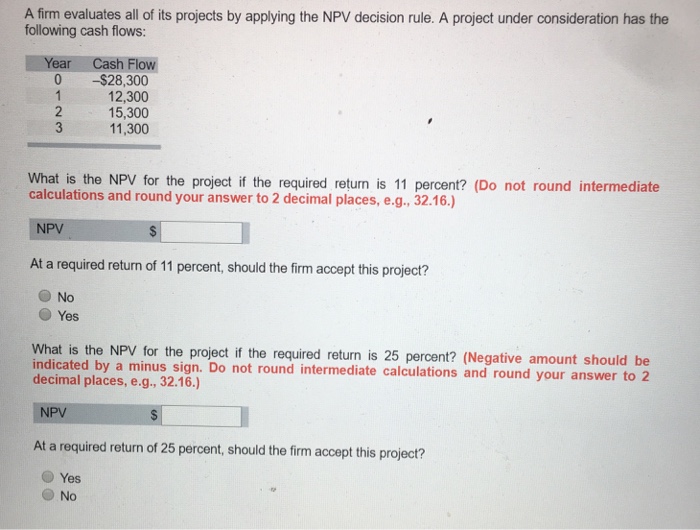

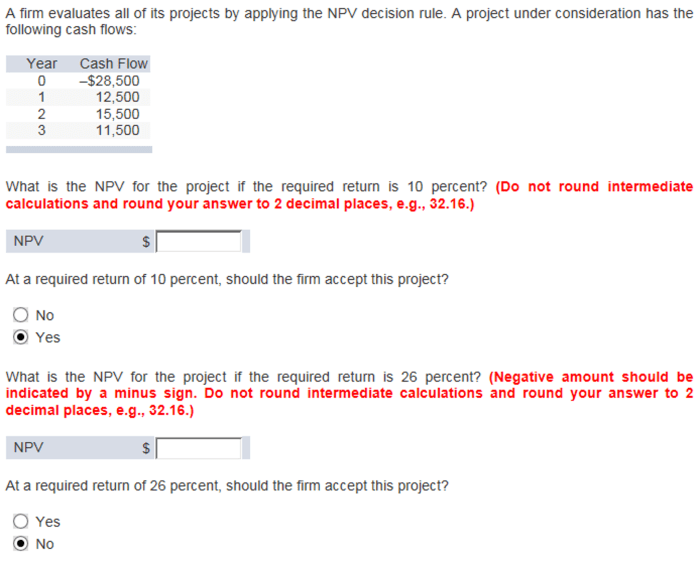

- Net present value (NPV)

- Internal rate of return (IRR)

- Profitability index

- Payback period

Non-financial criteria encompass:

- Market demand

- Technological feasibility

- Environmental impact

- Social impact

3. Evaluation Methods, A firm evaluates all of its projects

Firms use quantitative and qualitative methods to evaluate projects. Quantitative methods involve numerical analysis and include:

- Cost-benefit analysis

- Discounted cash flow analysis

- Scenario analysis

Qualitative methods are subjective and consider non-quantifiable factors, such as:

- Expert judgment

- SWOT analysis

- Multi-criteria decision analysis

4. Project Selection Process

After evaluating projects, firms engage in a project selection process that involves:

- Prioritizing projects based on their evaluation results

- Considering the firm’s strategic goals and resource constraints

- Making decisions on which projects to pursue

5. Impact of Evaluation on Firm Performance

Effective project evaluation positively impacts firm performance by:

- Improving project selection decisions

- Reducing the risk of project failure

- Optimizing resource allocation

- Aligning projects with strategic goals

6. Best Practices for Evaluation

Industry best practices for project evaluation include:

- Using a consistent and structured approach

- Considering both financial and non-financial criteria

- Involving multiple stakeholders in the evaluation process

- Documenting the evaluation process and results

FAQ Insights

What are the key benefits of project evaluation?

Project evaluation provides firms with a structured framework for assessing the viability and potential impact of projects, enabling informed decision-making, risk mitigation, and resource optimization.

How can firms ensure the effectiveness of their project evaluations?

Firms can enhance the effectiveness of their project evaluations by employing a combination of quantitative and qualitative methods, considering both financial and non-financial criteria, and involving stakeholders throughout the process.

What role does project evaluation play in strategic alignment?

Project evaluation serves as a critical tool for aligning projects with the firm’s strategic goals and objectives. By evaluating projects against strategic criteria, firms can ensure that their investments are aligned with their long-term vision and priorities.